-

PBID: 0030000300000015

-

3 people like this

-

6813 Posts

-

2 Photos

-

0 Videos

-

0 Reviews

-

Economics and Trade

Recent Updates

-

WWW.COINDESK.COMTom Lee's Bitmine Immersion Adds $800M of Ether, Bringing ETH Holdings Over $13BThe digital asset treasury bubble might have burst, as chairman Thomas Lee said, but the firm added over $1.6 billion worth of ETH during the crypto correction.0 Comments 0 Shares 0 Views 0 ReviewsPlease log in to like, share and comment!

WWW.COINDESK.COMTom Lee's Bitmine Immersion Adds $800M of Ether, Bringing ETH Holdings Over $13BThe digital asset treasury bubble might have burst, as chairman Thomas Lee said, but the firm added over $1.6 billion worth of ETH during the crypto correction.0 Comments 0 Shares 0 Views 0 ReviewsPlease log in to like, share and comment! -

WWW.COINDESK.COMSenate Republicans Call for Own Meeting With Crypto CEOs After Democrats' SitdownGOP lawmakers are scheduling a followup meeting with crypto CEOs after they meet this week with Senate Democrats on the market structure bill, sources say.0 Comments 0 Shares 0 Views 0 Reviews

WWW.COINDESK.COMSenate Republicans Call for Own Meeting With Crypto CEOs After Democrats' SitdownGOP lawmakers are scheduling a followup meeting with crypto CEOs after they meet this week with Senate Democrats on the market structure bill, sources say.0 Comments 0 Shares 0 Views 0 Reviews -

WWW.COINDESK.COMAsia Morning Briefing: Bitcoin Holds Steady as Market Resets After Leverage FlushGlassnode says last weeks selloff cleared out excess without breaking structure, while Enflux points to renewed institutional layering from Blockchain.coms SPAC and Bitmines $800 million ETH buildout as signs of deeper market resilience.0 Comments 0 Shares 0 Views 0 Reviews

WWW.COINDESK.COMAsia Morning Briefing: Bitcoin Holds Steady as Market Resets After Leverage FlushGlassnode says last weeks selloff cleared out excess without breaking structure, while Enflux points to renewed institutional layering from Blockchain.coms SPAC and Bitmines $800 million ETH buildout as signs of deeper market resilience.0 Comments 0 Shares 0 Views 0 Reviews -

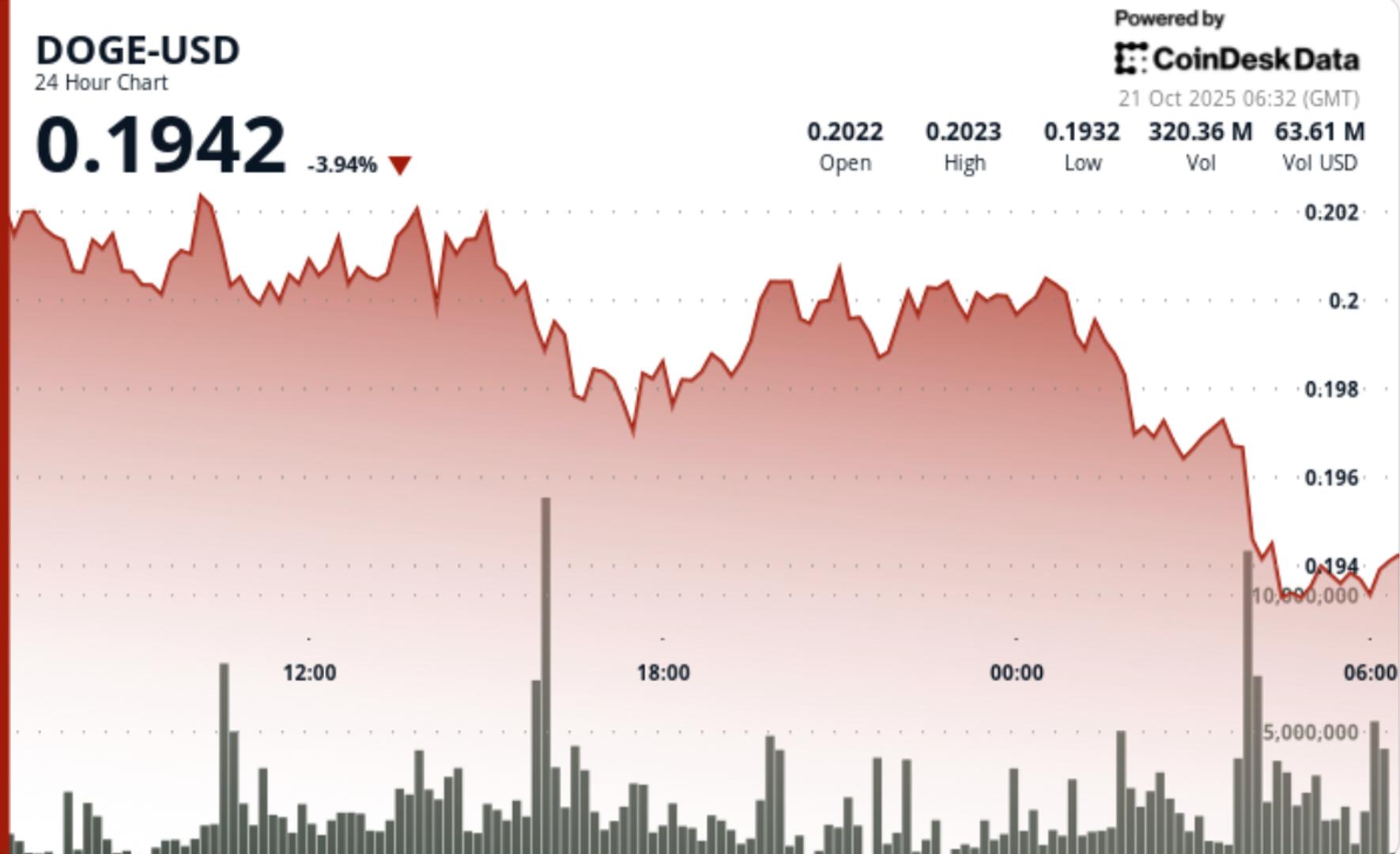

WWW.COINDESK.COMDOGE Consolidates Near Lows, but Watch $0.194 for Breakdown or Short-Cover RallySelling builds near $0.20 resistance after multiple failed breakout attempts, while macro stress keeps traders defensive across alt markets.0 Comments 0 Shares 0 Views 0 Reviews

WWW.COINDESK.COMDOGE Consolidates Near Lows, but Watch $0.194 for Breakdown or Short-Cover RallySelling builds near $0.20 resistance after multiple failed breakout attempts, while macro stress keeps traders defensive across alt markets.0 Comments 0 Shares 0 Views 0 Reviews -

WWW.COINDESK.COMBritish Columbia to Permanently Ban New Crypto Mining Projects From GridThe ban is part of an effort to manage electricity demand and ensure industrial development is powered by clean electricity.0 Comments 0 Shares 0 Views 0 Reviews

WWW.COINDESK.COMBritish Columbia to Permanently Ban New Crypto Mining Projects From GridThe ban is part of an effort to manage electricity demand and ensure industrial development is powered by clean electricity.0 Comments 0 Shares 0 Views 0 Reviews -

COINTELEGRAPH.COMCanadian province to ban new crypto mining connectionsBritish Columbia is moving to ban new crypto mining connections to protect its Hydro power grid. For years, analysts have argued this is the wrong approach.0 Comments 0 Shares 0 Views 0 Reviews

COINTELEGRAPH.COMCanadian province to ban new crypto mining connectionsBritish Columbia is moving to ban new crypto mining connections to protect its Hydro power grid. For years, analysts have argued this is the wrong approach.0 Comments 0 Shares 0 Views 0 Reviews -

COINTELEGRAPH.COMCorpo chains doomed unless they embrace cryptos ethos: StarkWare CEOStarkWare CEO Eli Ben-Sasson said corporate blockchains will help with mainstream adoption, but long term, they will be abandoned if they try to retain control.0 Comments 0 Shares 0 Views 0 Reviews

COINTELEGRAPH.COMCorpo chains doomed unless they embrace cryptos ethos: StarkWare CEOStarkWare CEO Eli Ben-Sasson said corporate blockchains will help with mainstream adoption, but long term, they will be abandoned if they try to retain control.0 Comments 0 Shares 0 Views 0 Reviews -

COINTELEGRAPH.COMBitcoin mining in 2025, explained: From hashrate to rewardsDiscover how Bitcoin mining runs in 2025: From halving rewards and ASIC rigs to mining pools, hashprice shifts and power use.0 Comments 0 Shares 0 Views 0 Reviews

COINTELEGRAPH.COMBitcoin mining in 2025, explained: From hashrate to rewardsDiscover how Bitcoin mining runs in 2025: From halving rewards and ASIC rigs to mining pools, hashprice shifts and power use.0 Comments 0 Shares 0 Views 0 Reviews -

COINTELEGRAPH.COMUS political turmoil tests institutional confidence as crypto ETFs bleedThe outflows came as No Kings protests swept across the US amid a prolonged government shutdown and political division, deepening market risk aversion.0 Comments 0 Shares 0 Views 0 Reviews

COINTELEGRAPH.COMUS political turmoil tests institutional confidence as crypto ETFs bleedThe outflows came as No Kings protests swept across the US amid a prolonged government shutdown and political division, deepening market risk aversion.0 Comments 0 Shares 0 Views 0 Reviews -

COINTELEGRAPH.COMBitcoin eyes CME gap below as BTC price dips 2.5% to risk $100K collapseBitcoin price dropped 2.5% on the day to attempt to fill the latest weekend CME futures gap, while traders warned that $100,000 could fail as support.0 Comments 0 Shares 0 Views 0 Reviews

COINTELEGRAPH.COMBitcoin eyes CME gap below as BTC price dips 2.5% to risk $100K collapseBitcoin price dropped 2.5% on the day to attempt to fill the latest weekend CME futures gap, while traders warned that $100,000 could fail as support.0 Comments 0 Shares 0 Views 0 Reviews

More Stories